Aurica Capital Joins the shareholding of Alquiler Seguro.

- The growth capital management company has invested in its fifth stake through its Aurica IV fund with the aim of boosting its growth.

- Alquiler Seguro, a leading company in lease management, generated 40 million euros in revenue last year and achieved an EBITDA of 4 million.

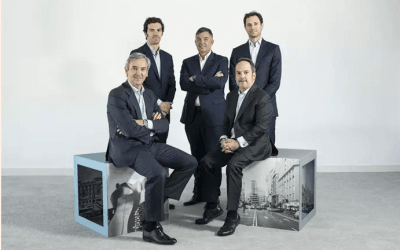

July 11, 2023 – Aurica Capital, an independent private equity manager in the expansion capital segment, has become a shareholder of Alquiler Seguro Grupo, a leading company in the rental sector in Spain with over 20,000 active contracts, after signing an agreement for 49% ownership.

With this move, Alquiler Seguro will have a top-tier partner that will enhance new business lines and enable the planned medium-term growth, following the professionalization process the company has undergone in recent years. Alquiler Seguro is the leader in the rental sector with an annual revenue of 40 million euros and more than 450 employees across 53 offices in Spain and Portugal.

According to Martín Vargas, Director of Investments at Aurica Capital, “The decision to invest in Alquiler Seguro is based on its strong market positioning. We will foster and drive its future growth, confident that our support, combined with the quality of its service and the value it provides to its customers, will help the company reach its next stage of development.”

In the words of Antonio Carroza, President of Alquiler Seguro: “Aurica’s experience and knowledge will accelerate our development and strongly drive Alquiler Seguro’s plans. This agreement represents a double satisfaction because it also attests to the professionalization initiated by the Group three years ago.”

Aurica Capital has executed this operation through its Aurica IV fund, which had an initial closing of over 200 million euros and marks its fifth investment since September 2022. Aurica’s other portfolio companies include the Larrumba restaurant group, the manufacturer and distributor of rest furniture Flex, the horticultural product distributor Agrosol Export, the company specialized in outsourced sales forces and point of sale management Winche, the masterbatch manufacturer for the cable industry Delta Tecnic, Babel, a digital transformation consultancy, SamyRoad, a company specializing in advocacy, influencer marketing, and branded content, t2ó, a digital marketing consultancy, Educa Edtech Group, a national leader in online education, Viatek, a company specializing in IT services and infrastructure, and Canitas, veterinary clinics.

EY served as the main advisor for Aurica, while KPMG and the prestigious Pérez-Llorca law firm were involved in the operation on behalf of Alquiler Seguro.

About Aurica Capital:

Aurica Capital is an independent private equity manager that invests in the expansion capital segment. The firm takes minority but significant stakes in middle-market Spanish companies with a clear vision of growth and expansion. Its portfolio companies generate over 70% of their sales internationally and include Agrosol, which produces and markets horticultural products; Grupo Larrumba, a prominent company in the restaurant sector; Winche, specializing in sales force outsourcing and point of sale management; Delta Tecnic, a manufacturer and distributor of masterbatch for the cable industry; Flex, a manufacturer of rest solutions; Babel, a consultancy specializing in digital transformation; SamyRoad, a company specialized in advocacy, influencer marketing, and branded content leading in Europe and Latin America; t2ó, a digital marketing, sales, and digital strategy consultancy; and Educa Edtech Group, a national leader in online education. Aurica Capital Desarrollo S.G.E.I.C., S.A., is registered with the CNMV as a company that manages risk capital entities under number 104.